CASE STUDY

CASE STUDY

Abakus is an online loan platform which allows borrowers to take complete control over the entire process of applying for and managing a mortgage.

Applying for a mortgage can be an arduous experience. Borrowers face a complex legal and financial process involving multiple stakeholders; the complexity of which is compounded by the lack of transparency surrounding the entire process. Enter Abakus. Abakus has created a whole new way of applying for a mortgage. The platform gives borrowers full visibility over every stage of their application, whilst providing new and innovative methods to configure and manage the terms of their loan.

Applying for a mortgage can be arduous. Borrowers face a complex legal and financial process involving multiple stakeholders; the complexity of which is compounded by the lack of transparency surrounding the entire process. Enter Abakus. Abakus has created a whole new way of applying for a mortgage. The platform gives borrowers full visibility over every stage of their application, whilst providing new and innovative methods to configure and manage the terms of their loan.

I joined the product team during the early stages of re-imagining the mortgage process. The product aimed to deliver a streamlined way for borrowers to apply for a loan, and to be the first in the market to allow them to do so completely online. In order to overhaul such a complex process, we first needed to ensure we understood it properly.

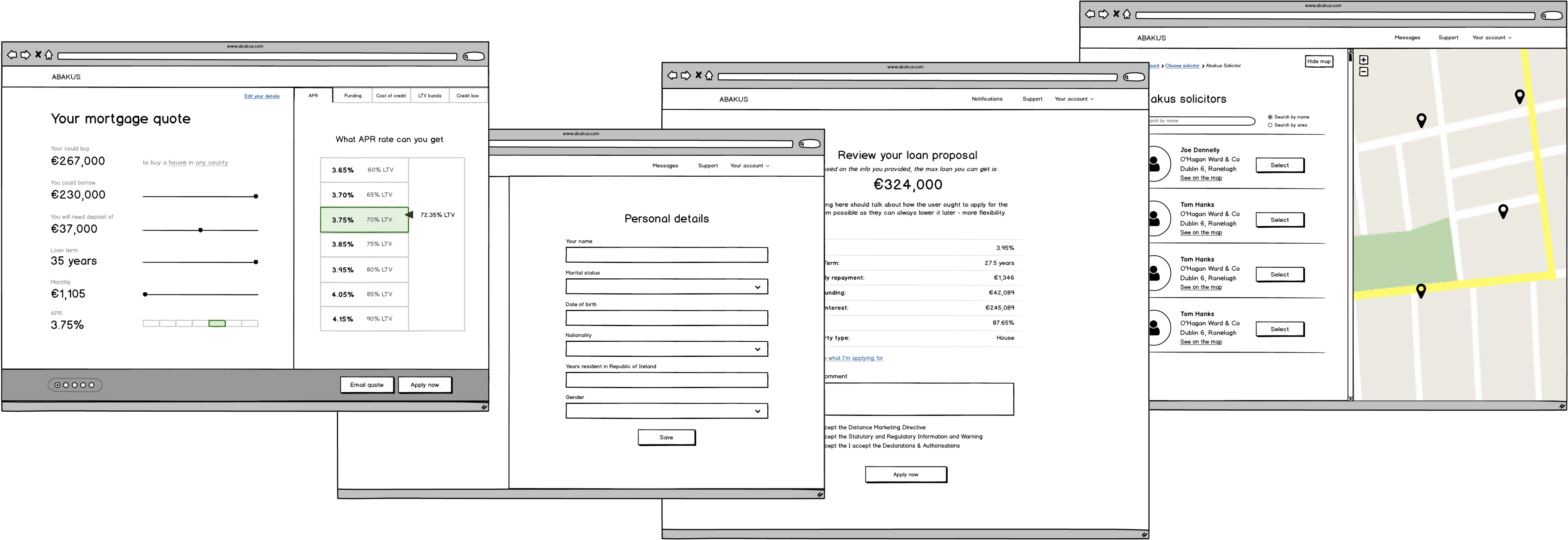

An initial phase of journey mapping was undertaken to make sense of the many complexities of the current system. We held discovery sessions with stakeholders in the bank to understand the roles they played in the process, and to determine the major pain points both for them and for the loan applicant. The primary user journeys were mapped out first on paper and then digitally - these journeys were frequently reassessed and updated over the course of the product’s development, as the intricacies of the loan application process came to light.

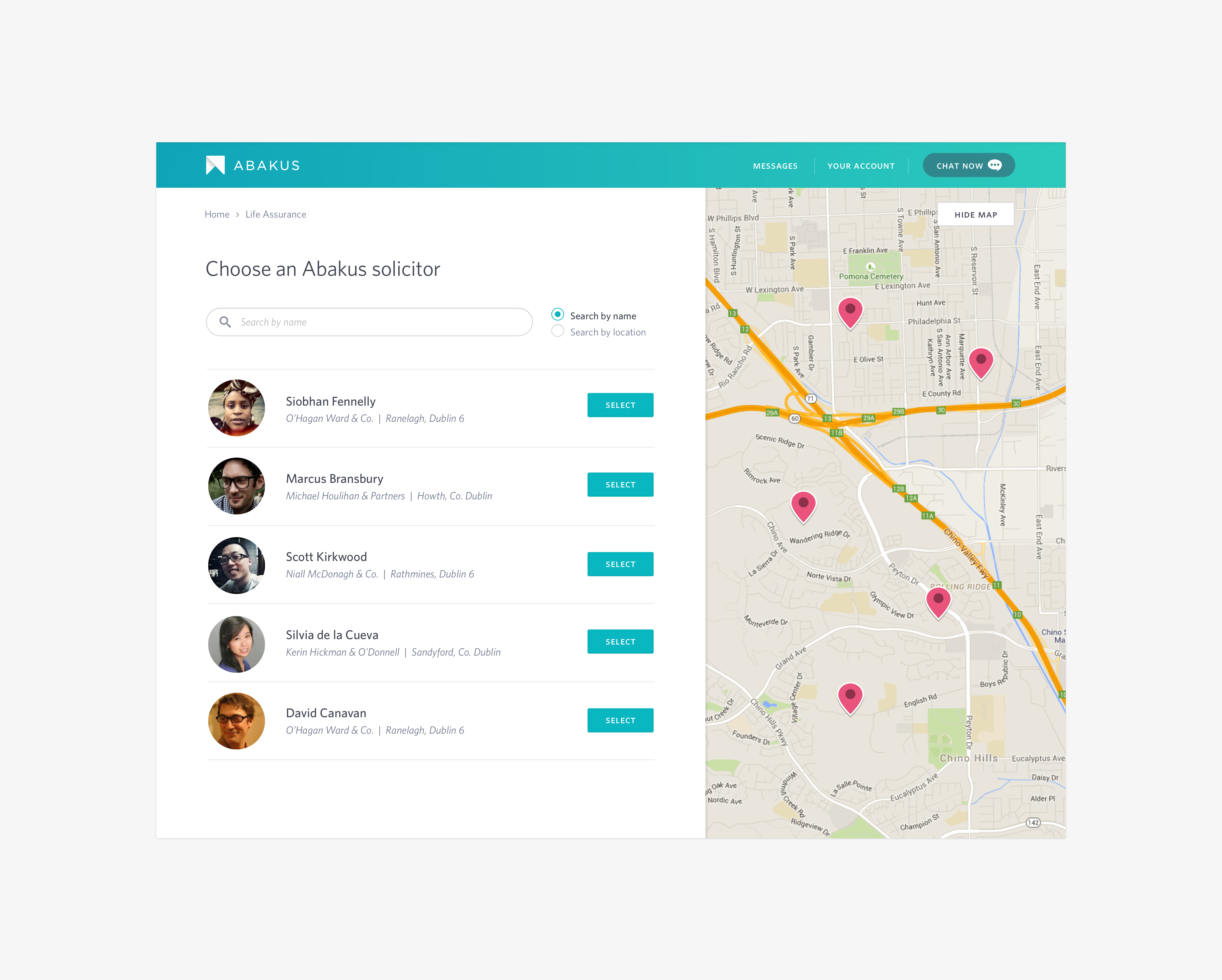

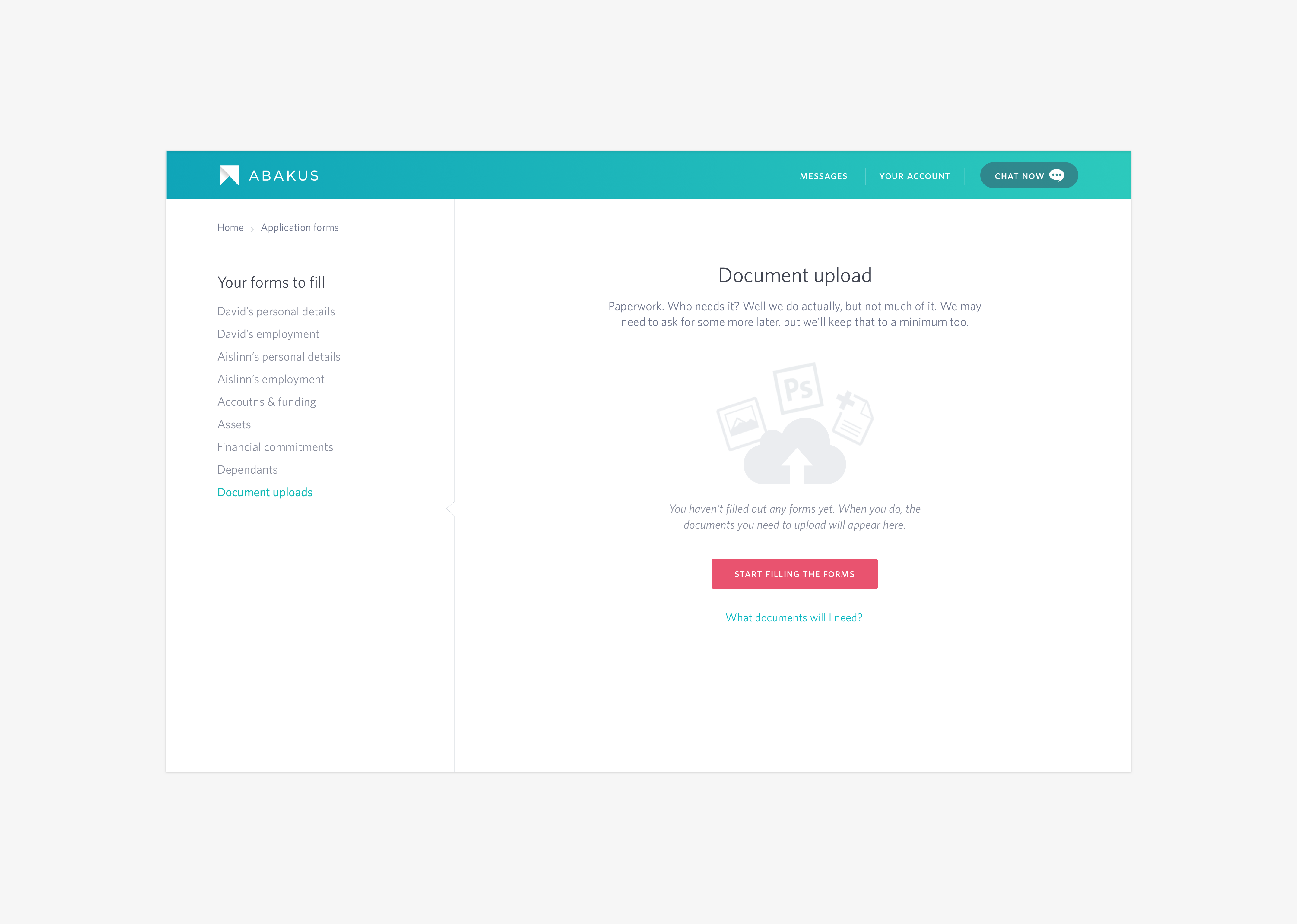

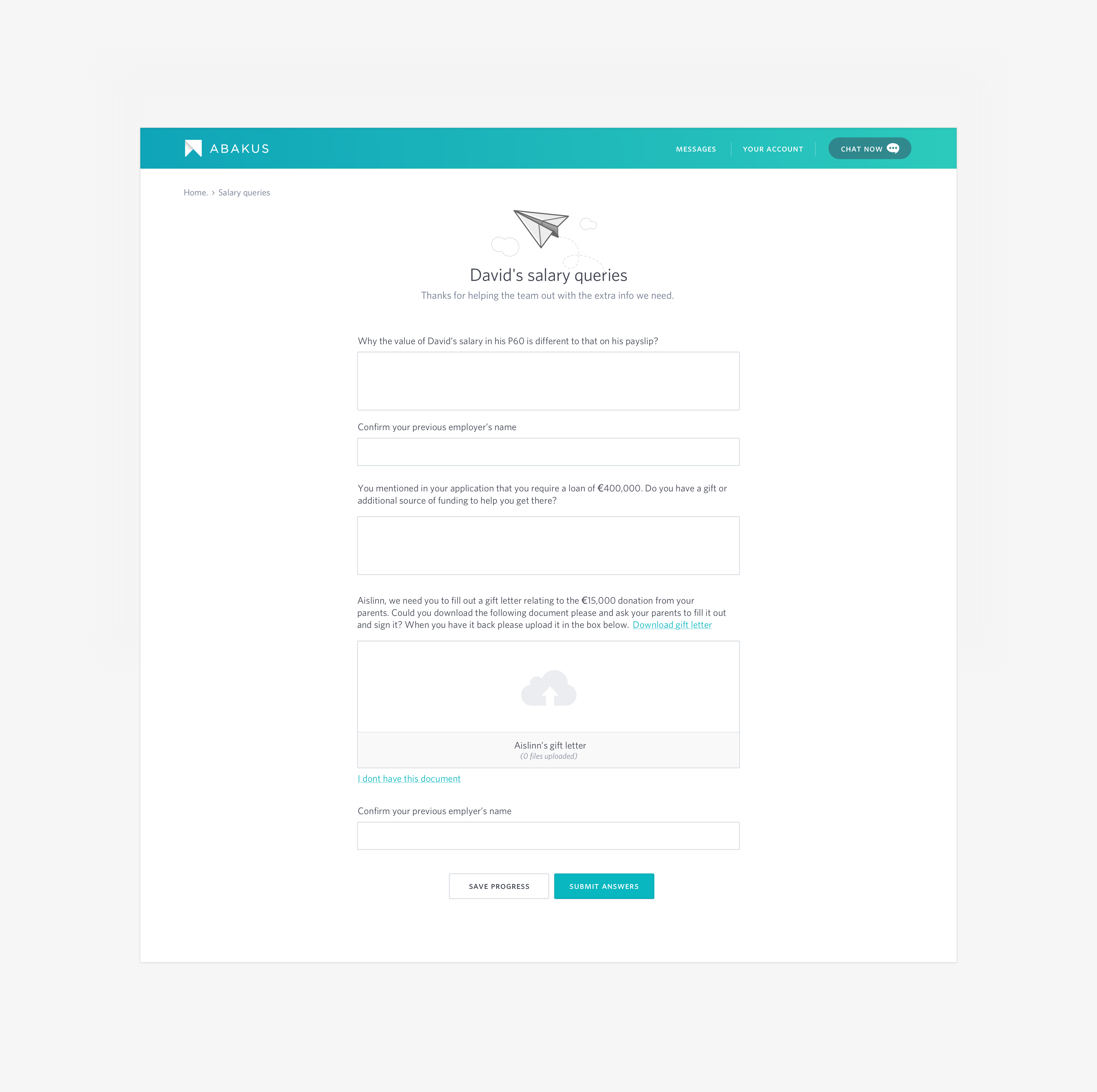

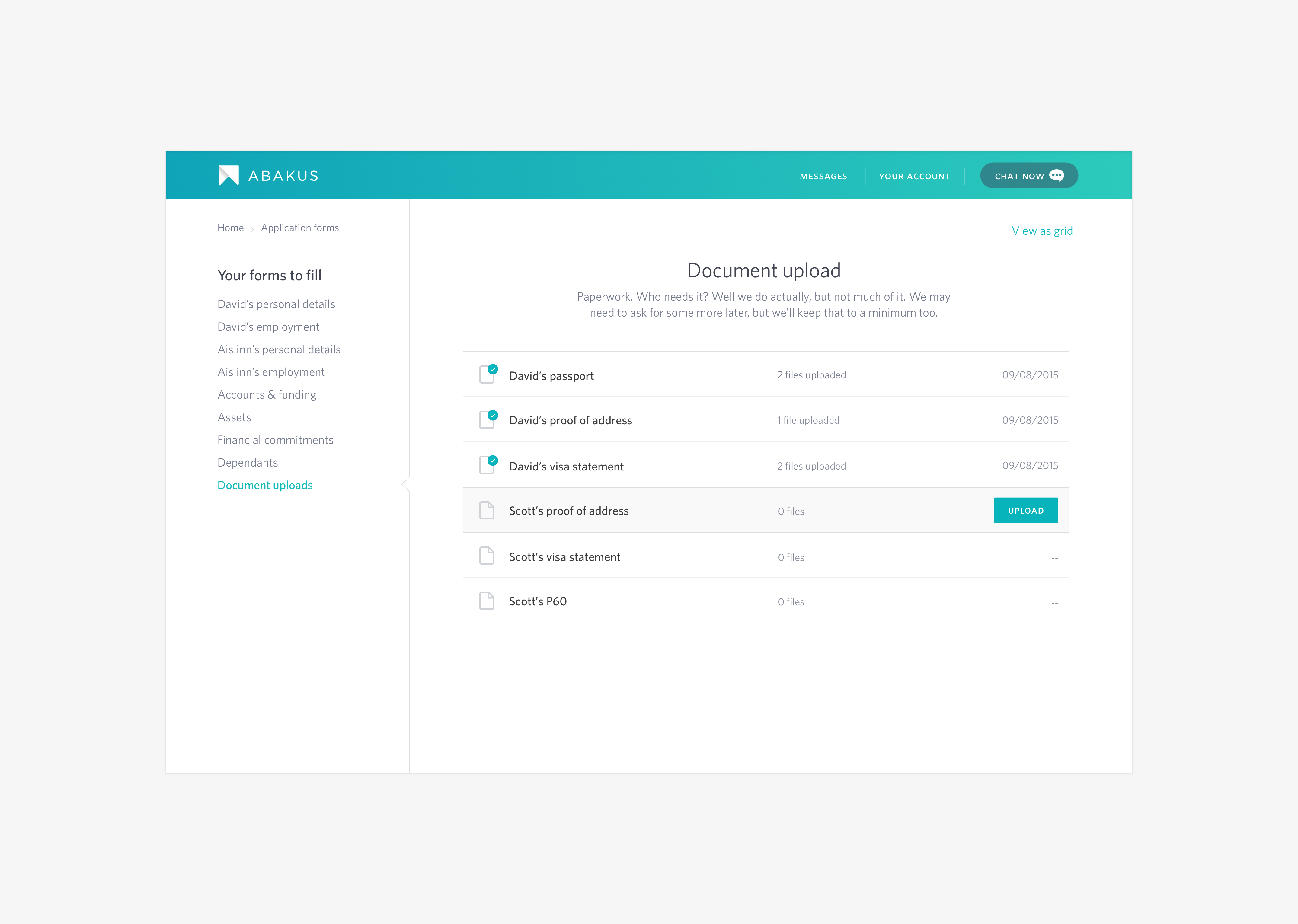

Personas were created for each of the stakeholders in the process - borrowers, underwriters, solicitors and back-office staff. All of these parties had touchpoints within the product, and all had very different requirements and expectations. The back-office platform for bank staff needed a completely different approach to the consumer-facing app. The former demanded speed and efficiency above all else, whilst the main objectives of the latter were simplicity, ease of use and an engaging user experience.

Once the core functional requirements for each persona were documented, high-level user journeys were mapped out. As these flows were solidified, we created low-fidelity wireframes of the initial interfaces. These were iterated upon continuously based on user feedback and ever-more detailed analysis from the business team.

The product design was kickstarted by mapping out the high-level IA of the app. As Leveris is a modular platform, we needed to create an architecture that could be customised by the client depending on which product features they required. This was achieved by allowing the customer to add, remove and re-order individual modules.

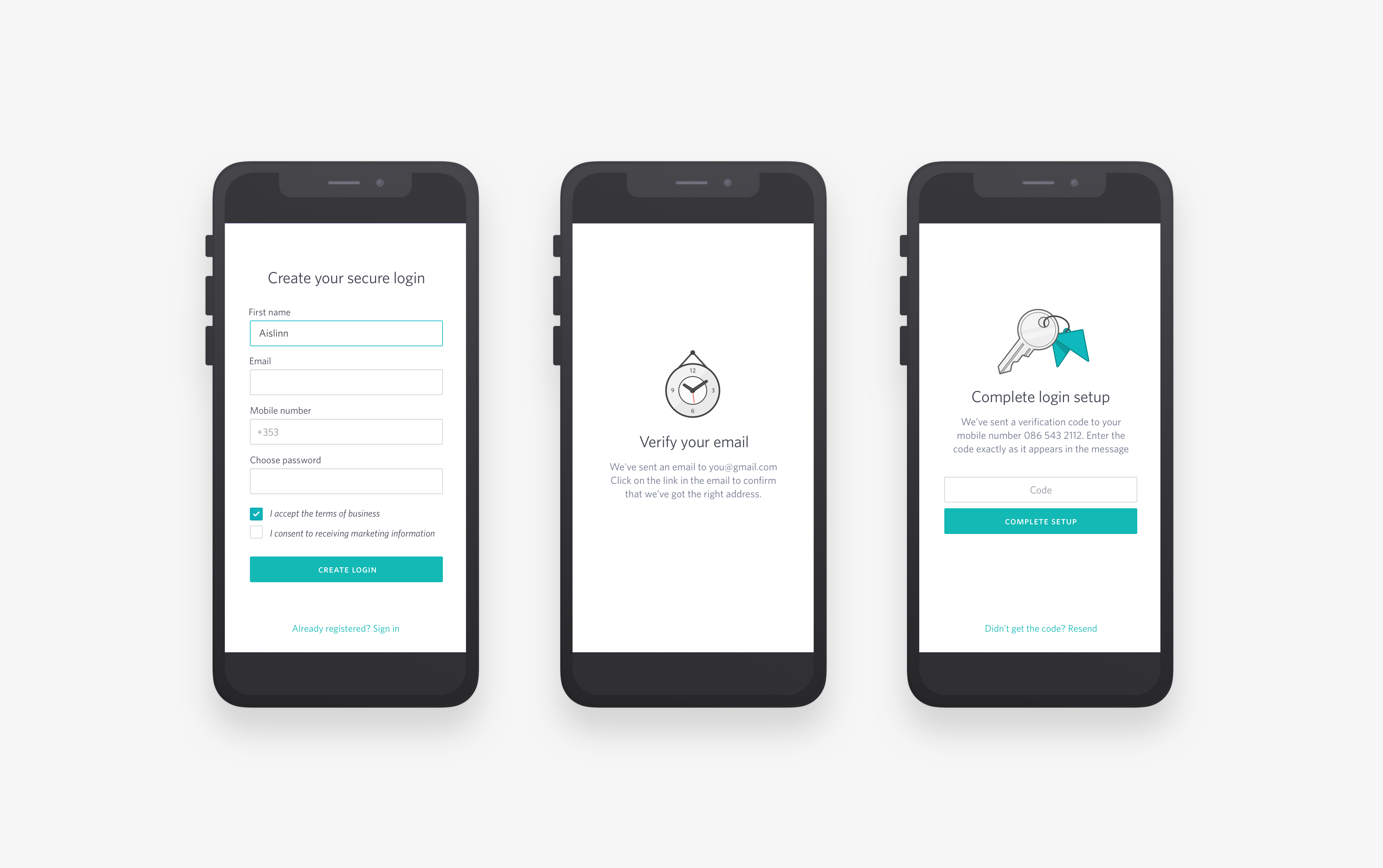

The prototype was designed both as an MVP and as a product demo for potential clients. For this reason we payed particular attention to the initial onboarding flows of the app - this would be the client’s first view of the product, and our first chance to make an impression.

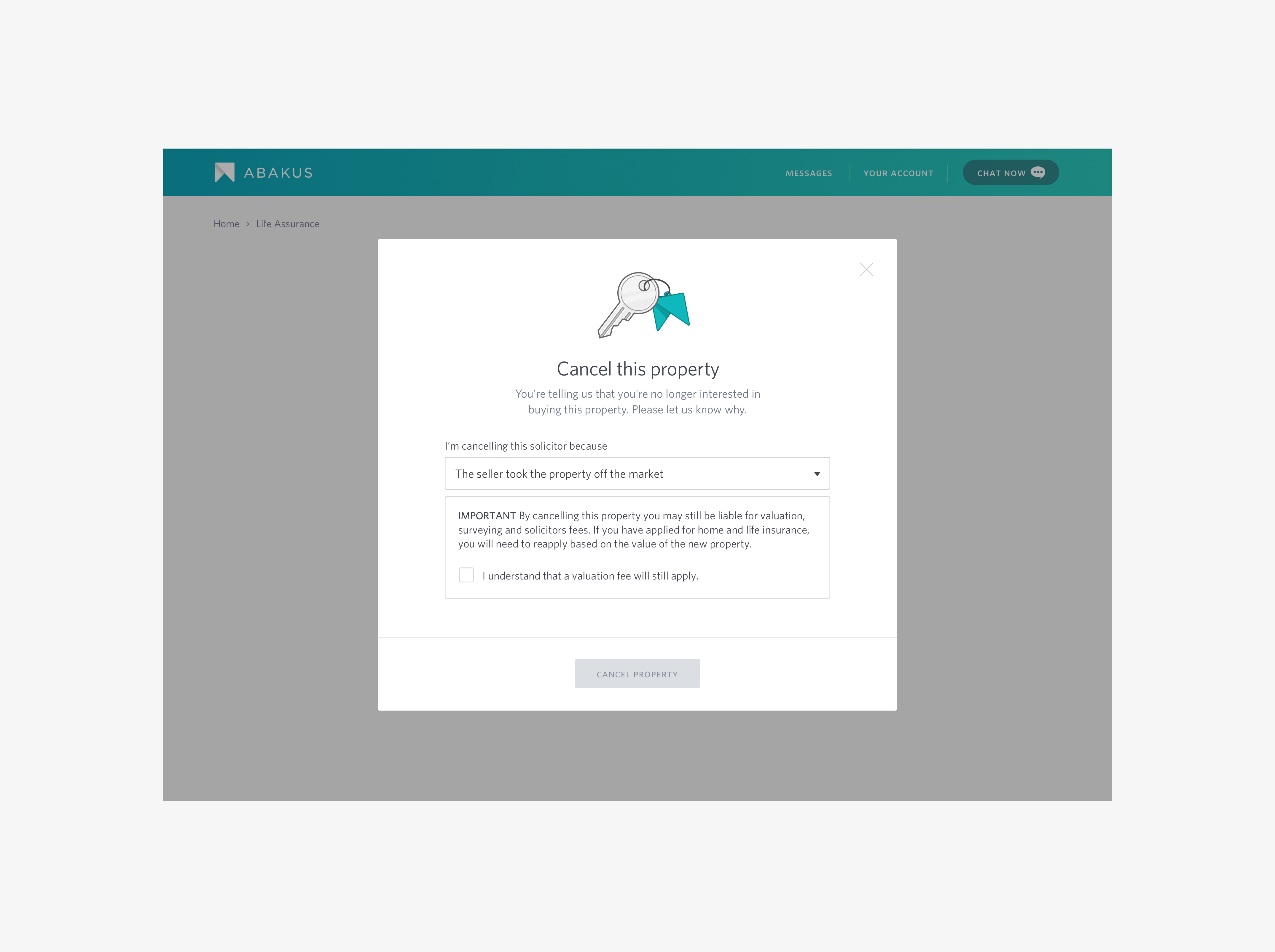

Given the nature of the product we were building, there were many unknowns in the UX. As no competitors offered an end-to-end digital loan application or management tool, we had no direct reference points for many of the features we were developing. This proved to be a major challenge at times, but became extremely rewarding as the team succeeded in finding solutions to the complexities of the product.

Abakus was a completely new entrant to the market, and a full branding exercise was undertaken alongside the development of the UI. We assessed the product’s intended brand values, target audience and competitive landscape, and from this developed the look and feel, tone of voice and market positioning.

This branding formed the basis of a comprehensive design system which we created to support the development of the UI. The design system ensured there was consistency throughout all the applications, while at the same time speeding up development and allowing for rapid high-fidelity prototyping.

One of the most fulfilling parts of working on this project was the emphasis put on customer experience throughout. Abakus aimed to be best-in-class not just technologically, but in every interaction and every touchpoint the user had with the brand.